Who Pays the Bills If You Can’t? Understanding Durable Financial Powers of Attorney in Ohio

Life doesn’t pause for the unexpected. If you couldn’t access your accounts or pay your bills tomorrow, who would handle it? A Durable Financial Power of Attorney (POA) gives someone you trust the authority to step in when you can’t.

Think of it as handing someone you trust a spare key to your financial life.

What Is a Durable Financial POA?

In Ohio, a Durable Financial POA is a legal document that lets you name a trusted person, called your agent, to make financial and property decisions on your behalf.

The keyword is durable: it stays valid even if you become incapacitated. Without it, your loved ones may have to go through the probate court to be appointed as a guardian, which is both time-consuming and stressful.

Immediate vs. Springing

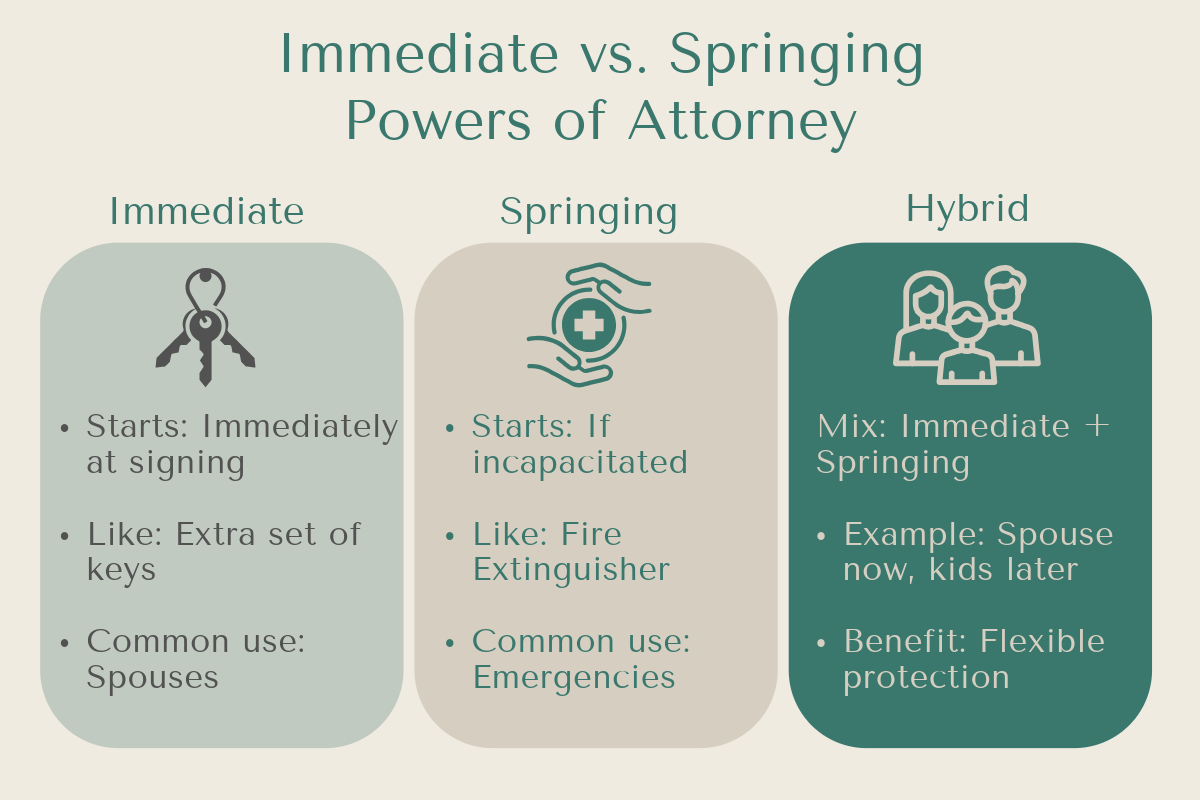

You get to decide when your Power of Attorney takes effect, and in Ohio, you can even blend the two approaches.

Immediate POA: Your agent’s authority begins as soon as you sign the document. Think of it like giving someone a second set of car keys; they can drive whenever you ask. Many married couples choose this option for convenience, naming a spouse as their immediate agent so day-to-day financial matters can be handled seamlessly.

Springing POA: The powers only “spring” into effect after a certain event, usually when a doctor certifies that you are incapacitated. Like a fire extinguisher behind glass, it’s there for emergencies.

Hybrid Approach: You don’t have to choose one or the other for everyone. For example, you might name your spouse as your immediate agent so they can handle finances right away if needed. At the same time, you could name your adult children (or other trusted individuals) as successor agents, but make their authority springing. This means they would only step in if both you and your spouse were incapacitated.

What Powers Can an Agent Have?

Under Ohio law, your agent can be given broad or limited authority. Common financial powers include:

Pay bills, manage bank accounts, and handle everyday expenses

File your taxes

Buy, sell, or manage real estate in Ohio

Oversee investments, retirement accounts, or insurance matters

Manage business interests

You can make the authority broad or limit it to specific tasks.

What a Durable POA Can’t Do

A common misconception: a POA works after death.

It doesn’t.

Once you pass away, the POA ends immediately. At that point, your will or trust takes over.

Why Every Ohioan Should Consider One

A Durable Financial POA gives you peace of mind knowing someone you trust can step in quickly if life takes an unexpected turn. Without it, your family may face court proceedings just to manage basic financial matters.

Next Steps

If you live in Ohio and don’t yet have a Durable Financial Power of Attorney, or if yours hasn’t been reviewed in years, Ballinger Legal can help. We’ll make sure your POA reflects your wishes and works smoothly with the rest of your estate plan. Contact us today to get started.